cpo trading malaysia

Cargill Palm Products Sdn Bhd. Trading Strategy When to Buy and Sell the Crude Palm Oil Futures Contract FCPO Recommended Learning Hours.

The Trend Of Trade Value And Quantity Of Indonesia S Cpo Export In The Download Scientific Diagram

We wish all the best to whom had purchased the book.

. OPTIONS ON CRUDE PALM OIL FUTURES OCPO CONTRACT Level 6 Kenanga Tower 237 Jalan Tun Razak 50400 Kuala Lumpur Malaysia. When on spot without the capability to short the most logical move is a rotation towards the most Risk-Off asset there is Agriculture. View Calendar contract specs.

603 2172 2729 Email. Launched in October 1980 Crude Palm Oil Futures is the most successful commodity futures contract in Malaysia. Home Agricultural and Energy Industry CPO.

60 3 22463188 Contact. CPO Futures Trading. Price shown for SBO Rott is on a two day delay due to time zone difference.

Showing 130 of 83 results. 13 hours agoTuesday 14 Jun 2022 143 PM MYT. Malaysian Crude Palm Olein Calendar futures.

60 3 22463111 Fax. To increase the market liquidity and trading volume Bursa Malaysia Derivatives had. 5 hours agoLevel 4 Lot 6 Jalan 5121746050 Petaling Jaya SelangorMalaysia Tel.

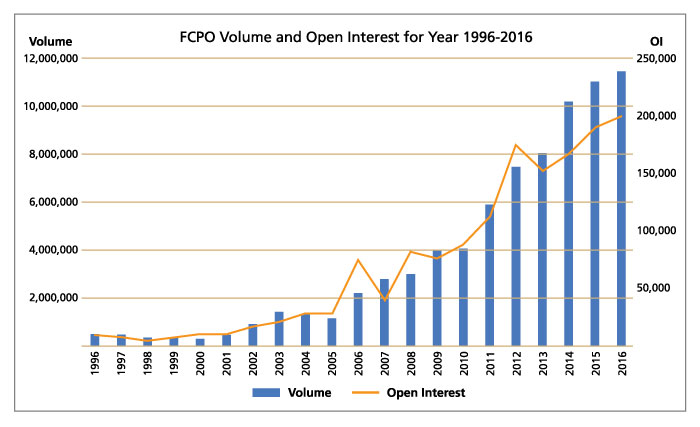

Since the conversion to screen-based trading from the open outcry trading volume has increased considerably. 50000 Metric Ton Month Payment Terms. The main users of the futures market include the refiners plantations millers brokers and dealers.

603 2172 3888 Fax. OCPO is a Ringgit Malaysia MYR denominated Options Contract traded on Bursa Malaysia Derivatives with Crude Palm Oil Futures Contract FCPO as its underlying instrument. In a research note today the investment bank said the projection is based on the lifting of Indonesias export ban at the end of May which.

Level 47 Menara TM Off Jalan Pantai Baru 59200 Kuala Lumpur Malaysia. CGS-CIMB Research expects crude palm oil CPO price to trade at between RM3200 and RM3700 per tonne in March 2021. Monday June 14 2010.

This is in view of projected low inventory in Malaysia which. 603-7785 2624 603-7785 2625. Crude Palm Oil futures for August contract open at 2485 and closed at 2436 yesterday.

7 hours agoKUALA LUMPUR June 14. FCPO is a Ringgit Malaysia MYR denominated crude palm oil futures contract traded on Bursa Malaysia Derivatives which providing market participants with a global price benchmark for the Crude Palm Oil Market since 1980 in the Commodity Futures Exchange. Offers cash-settled exposure for those unableunwilling to take delivery in the FOB.

Cargill Palm Products Sdn Bhd is a pioneer in specialty oils fats supplying quality ingredients for the confectionery beverage and frozen dessert industries. 8 hours agoThe CPO futures markets of Bursa Malaysia have seen increased participation due to the recent price volatility in palm oil and the FEPO contract reached a. CPO Malaysia Blog.

The CPO Futuress stop and reverse trade signals in year 2017 had generated accumulated gross profit 21 ticks ONLY based on the 101indicators On Futures Trading book which the book has been retired officially purposely out-of-print on 11122017 today. 5000 Meter Supplying Ability. LC TT Business Type.

List of Bursa listed company affected by CPO market price. DISCLAIMER- Malaysian Palm Oil Councial MPOC shall not be liable for any loss of damage caused by the usage of. Crude Palm Oil CPO FOB Price.

Malaysian Crude Palm Oil Calendar futures. Riopal Pro May 20. MPOB DAILY MALAYSIA PRICES OF CRUDE PALM OIL RMTONNE Harga Harian Minyak Sawit Mentah - Malaysia RMTan 2021.

KUALA LUMPUR June 14 Malaysias crude palm oil CPO export volume is expected to ease month-on-month m-o-m in June said Maybank Investment Bank Maybank IB. I DO IT MY WAY of Forecasting The Market For Day Trading Purposes. Under normal conditions gains in this area would be meagre at best.

Crude palm oil crude palm oil futures Day trading CPO make money palm oil futures. 730 750 Metric Ton Get Latest Price Min Order. The market has taken a turn to a risk off scenario.

Monday to Friday Malaysia time Morning trading session. The CPO Futures markets of Bursa Malaysia Derivatives have seen increased participation due to the recent price volatility in palm oil. In May the FEPO contract reached a new daily trading volume high of 186 contracts equivalent to 4650 metric tonnes of CPO.

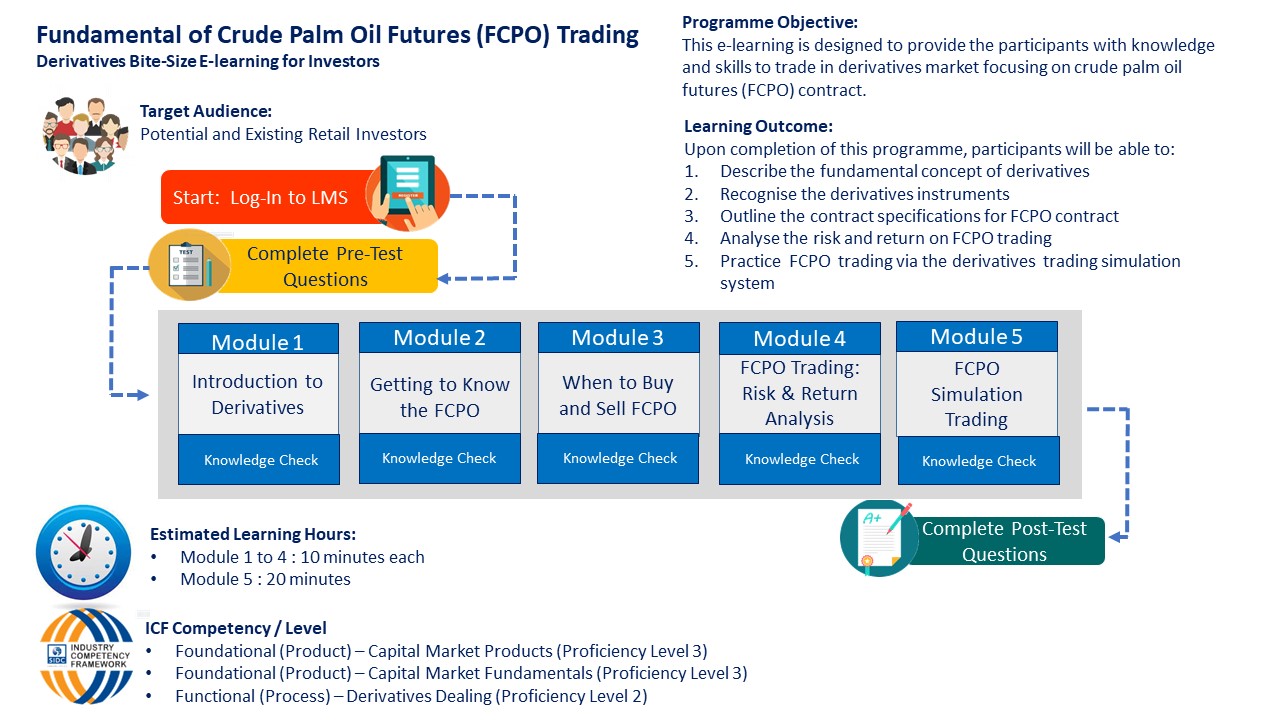

Based on the BMD Crude Palm Oil futures and cash-settled to a monthly average so participants can hedge monthly production with a single trade. Sign of going up. By the end of this module you will be able to understand crude palm oil futures contract FCPO and outline the contract specification and its key terms and conditions.

Monday May 24 2010. Bursa Malaysia Derivatives Bhd has completed the first physical delivery under the East Malaysia Crude Palm Oil Futures FEPO contract in Sarawak last Friday June 10In a statement released on Tuesday Bursa Malaysia said the delivery saw a total of 10 contracts representing 250 metric tonnes of crude palm oil CPO transacted at the port. Click for more details of rating estimated profit and fundamental analysis results.

Crude Palm Oil Settled Up By 0 48 At 401 1 Ways2capital Ncdex Tips Free Agri Commodity Tips Best Ncdex Tips Ncdex Trading Tips Olio Di Palma Alimenti Olio

Financial Management Solutions Fortune My Financial Management Solutions Energy

Crude Palm Oil Futures Global Oil Fats Business Online Gofbonline Com

Promotion Of Indian Handicrafts At Index 2015 International Design Exhibition Dubai Uae Epch Company Logo Exhibition Activities

Fundamental Of Crude Palm Oil Futures Fcpo Trading Sidc Delivering Professional Excellence

Fcpo1 Charts And Quotes Tradingview

Fcpo1 Charts And Quotes Tradingview

Cpo Futures To See Cautious Trading Next Week Mywinet

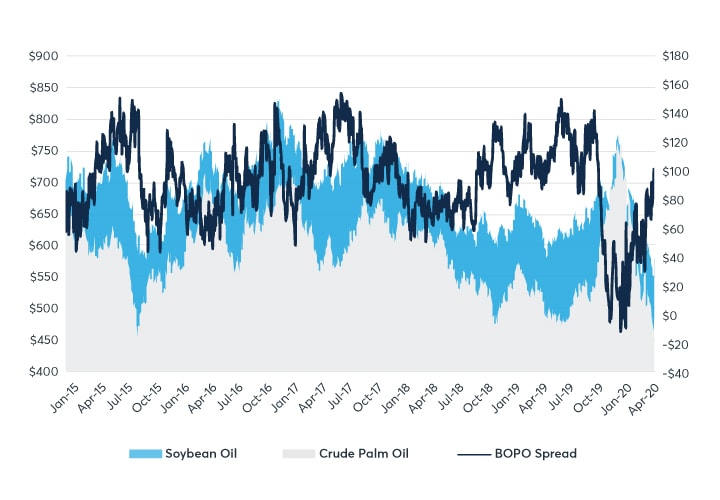

Palm Oil Spread Volatility Creates Opportunities Cme Group

Cpo Trading Range For The Day Is 495 5 513 3 Crude Palm Oil Prices Gained Tracking Firmness In Spot Demand And Overs Best Cooking Oil Palm Oil Immune Boosting